Sole traders vs limited company: what’s better from a tax point of view?

Whether you are starting your own business or have had your business for a while, you may have heard that operating as a limited company can help you save tax, when compared to operating as a sole trader.

In this blog, we look at this common belief in more detail and consider in what scenarios operating through a limited company may leave you in a better tax position.

There are of course other points to consider, such as personal liability, paperwork required and legal duties so please get in touch if you would like to discuss which business structure is most suitable for you.

Tax obligations

Both types of trading style come with different tax obligations.

Sole traders pay income tax on profits as well as National Insurance (class 2 and 4) but no corporation tax.

Limited companies pay Corporation Tax on profits – which traditionally, has been lower than higher rates of income tax – and no National Insurance.

| Income tax | National Insurance | Corporation Tax | Dividend Tax* | |

| Sole Trader | Yes | Yes – class 2 and 4 | No | No |

| Limited Company | No | No | Yes | Yes |

*if applicable

Another important point to consider is that limited companies are not entitled to a personal allowance, whereas sole traders are. The personal allowance is the amount of income an individual can receive before it gets taxed. For the tax year 2021/22 the personal allowance is £12,570. This amount has been frozen for the next 5 tax years.

Upcoming changes

- National Insurance contributions are increasing from April 2022 which will impact sole traders (please refer to our previous blog for further information on the increase)

- Dividend tax will be increasing from April 2022 which will impact directors of limited companies who are shareholders and receive payments via dividends (please refer to our previous blog for further information on the increase)

- Corporation tax will be increasing from 19% to 25% in April 2023 – a significant increase

An example

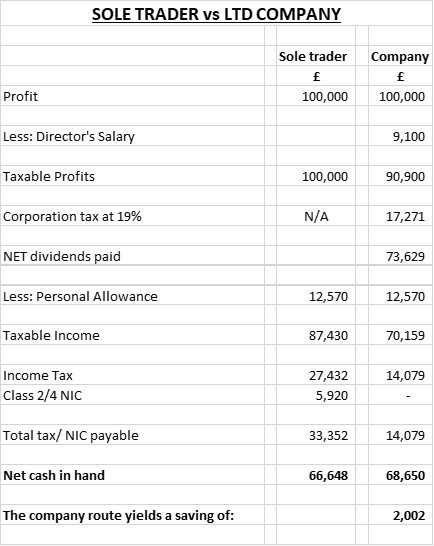

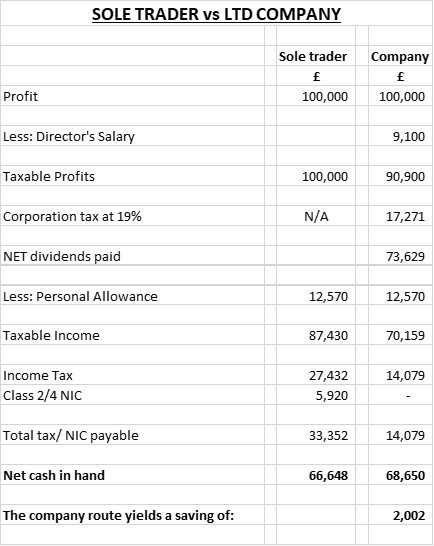

Mrs Hargreaves set up her own online clothes business with profit of £100,000.

We set out the tax comparison for sole trader vs limited company for the 2022/23 tax year below. These calculations are for illustration purposes only. Please contact us for bespoke calculations that take into account your personal circumstances

In summary

With National Insurance and dividend tax going up and corporation tax due to increase, the gap of being able to make a tax saving is getting increasingly smaller, therefore making it harder to say whether one option is better than the other – it will depend on many factors, many of which go beyond the pure tax obligation element.

Please always seek advice from an accountant, such as our team here at Hartley Fowler – just get in touch and our friendly team will be happy to advise you.