10 steps to future proofing your business

Changing landscape

In times of economic and political uncertainty, many business owners are looking for strategies to help them prepare for changing times, and to enable their business to make it in the long run. And for good reason as the stats don’t look great:

- 80% of new companies close their doors after 18 months

- It’s 50:50 that they will still be open in 5 years

- 70% of businesses don’t see their 10th anniversary

All businesses need to consider future proofing. In recent years, digitalisation has opened up a whole host of opportunities – the challenge is to work out how to use which technology to your advantage.

So how can you ensure that your business makes it in the long run?

1. Identify type of business – start up, growing, mature

Knowing where you are in the business life cycle helps you understand what’s likely to happen next, and how you can create a plan for the future

2. Innovate to differentiate

Mature businesses need to consider ways to stay ahead of the competition through innovation – are there ways your business could offer your service/product more quickly, better, or simply differently? Empowering your team to explore routes to innovation not only shows strong leadership but helps to nurture them.

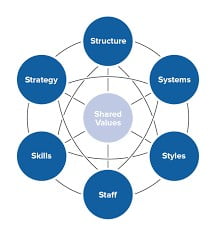

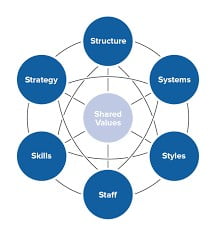

Consider McKinsey’s 7-S framework and how the different parts of your business are connected – do they align and inform each other?

3. Strategy

Does your organisation have a clear strategy, and are all stakeholders aware of it? Plan the destination, but be flexible with the route. All parts of the organisation need to work in harmony to achieve the plan.

4. What should the plan include?

- Current and future product/service delivery

- Marketing

- Financial performance and management

- Embracing changes in technology

- Embracing changes in working patterns

5. Marketing

Developing a clear and structured plan for delivering your products/services to market will provide structure to any marketing activities. Objectives, targets and KPI’s can be used in conjunction with an action plan to help keep the team accountable and provide a clear path for growth. Embrace digital media and the opportunities this offers.

6. Skills and training

Invest in your people through training and development. Whilst technology can be a great help, remember that ultimately, people still buy from people.

7. How is your business funded?

- Own funding/friends and family

- Traditional funding – bank loan/overdrafts or factoring

- Look at alternative – Funding Circle/Crowd funding

- What about SEIS/EIS – tax efficient investment

8. Financial performance

Having set the plan, review actual outcomes to the plan on a regular basis. Don’t be constrained by the plan but flex it to take account of the changing circumstances. Develop a “dashboard” approach to understanding your business and embrace technology that can support this.

9. Profit extraction vs profit retention

Our team can assist with these points, but consider the following points that should be part of the plan:

- Understanding cash vs profit

- Salary and/or dividends and net of tax returns

- Use of pension schemes

- Profit extraction vs profit retention

10. Monitor and adapt

Set time aside on a regular basis to monitor activity and progress compared to the plan. Be flexible in your approach to achieve your business objectives. Don’t be constrained by the plan but work with it and evolve the plan whilst being reflective.

Once you have the keystones in place, your business will be ready for the challenges of tomorrow. Our team can assist you develop a clear path for the future of your business and support you on the journey.

“The winds of change are blowing. You cannot change the direction of the wind, but you can change the angle of the sail”

Disclaimer: The information in this blog is correct at the time of writing and is to be used as general guidance only. Please contact your local Hartley Fowler office for specific advice.